The world of money can commonly seem like a labyrinth, specifically when you’re considering something as vital as your retirement cost savings.

Today, let’s dive deep into an economic step that’s been catching the eye of numerous savers: rolling over a 401k to Gold individual retirement account.

What is a Gold individual retirement account?

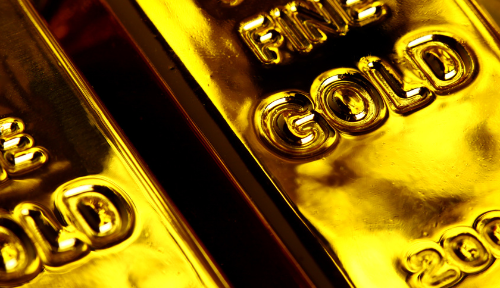

When you think about a pension, the initial image that could pop into your head is a collection of papers representing supplies, bonds, or mutual funds. These are called paper properties. Nevertheless, a Gold individual retirement account paints a various, more tangible image. Here, instead of depending on paper, you’re anchoring your cost savings on solid gold, a material that mankind has valued for centuries.

Yet just what is a Gold IRA? At its core, a Gold Individual Retirement Account is an Individual Retirement Account, rather comparable to the typical ones. The significant difference lies in what you’re buying. Instead of equities, bonds, or various other paper properties, a Gold individual retirement account is focused solely on precious metals, with gold taking the key spotlight. And while gold is the primary star, some Gold IRAs could likewise allow for silver, platinum, or palladium. So, it’s not nearly gold; it’s about concrete assets that have innate value.

Currently, why is the concept of a Gold IRA so enticing for several investors? Allow’s break it down:

Tangibility: In an era dominated by electronic numbers and abstract possessions, there’s a profound complacency in having something concrete. With a Gold IRA, your financial investment isn’t just a number on a screen; it’s a physical property you can touch, really feel, and, if essential, hold in your hand. This tangible nature of gold makes it distinct from supplies or bonds that represent an assurance or an IOU.

Historical Value: Gold isn’t a brand-new craze. It’s been an icon of wide range, power, and high-end for countless years across different people. From ancient Egypt’s Pharaohs to today’s reserve banks, gold has been hoarded, treasured, and used as a tool of trade.

Strength: When the economic skies get cloudy, and financial tornados begin to make, gold has traditionally shown strength. During times of rising cost of living, currency devaluation, or recessions, gold’s worth has actually often continued to be stable and even appreciated. This security contrasts sharply with paper assets, which can rise and fall wildly based on business efficiency, market interruptions, or geopolitical occasions.

Independence from Companies: Stocks and bonds are basically tied to the success and integrity of companies or federal governments. If a business goes bankrupt or performs poorly, its supply value can plummet. Gold, nonetheless, doesn’t have board meetings, quarterly reports, or management turn overs. Its worth isn’t hitched to a business’s success or failing.

Worldwide Recognition: Gold is universally identified and desired. Its worth isn’t restricted to certain regions or countries. Regardless of where you remain in the world, gold keeps its significance and worth.

Taking into consideration all these factors, a Gold IRA uses a special proposition. It permits you to diversify your retirement portfolio, making certain not all your eggs remain in the paper-asset basket. While every financial investment includes its threats and it’s important to stabilize and expand, presenting gold into the mix can supply stability, particularly in unsure financial environments.

Exactly how to Open a Gold Individual Retirement Account?

The choice to invest in a Gold IRA is not just about future economic gains; it’s additionally concerning protecting the worth of your possessions. Opening Up a Gold IRA can feel like a hilly task for the uninitiated, but allow’s simplify step by step to make it a lot more digestible.

Most importantly, the structure of your Gold individual retirement account is the custodian. Consider your custodian as a mix of a protector and an overview. They are responsible for handling all the management tasks of your Gold individual retirement account, that includes everything from paperwork to making sure conformity with the IRS’s policies and regulations. Yet not all custodians are developed equivalent.

When selecting one, it’s essential to discover a person reliable. Read reviews, ask for references, and do not hesitate to carry out interviews. Ensure they have a history of ethical methods, and their cost frameworks are transparent. Hidden fees can erode your cost savings over time, so having a clear picture upfront is paramount. In addition, a custodian with excellent client service can be vital. This is your retirement we’re discussing, and you desire somebody responsive and educated when you have concerns or worries.

Once you have actually got your custodian in position, the next challenge item is the vault. This is where your physical gold will certainly live. While the principle might seem uncomplicated– besides, it’s simply storage– there are numerous subtleties to consider. Gold IRAs need particular, IRS-approved vaults.

These are not just normal vaults; they comply with strict criteria to make sure the safety and safety and security of your properties. When picking a depository, look past simply authorization standing. Examine their safety and security procedures. Are they making use of modern technology? Do they have 24/7 monitoring? Furthermore, consider their insurance coverage. In the not likely event something fails, you wish to guarantee your investment is shielded. Some depositories additionally offer set apart storage, ensuring your gold is kept individually from others, which can be a plus for several investors.

Lastly, allow’s discuss the celebrity of the program: the gold itself. It’s simple to assume that you can roll any gold property into your individual retirement account, yet that’s not the situation. The internal revenue service has rigorous standards on the purity and kind of gold eligible for IRAs. Generally, gold bullion, which is pure gold in bar form, is a prominent option among investors as a result of its simple assessment and pureness. Popular alternatives like the American Eagle coins are authorized, but lots of international coins or those with collectible worth might not be.

Your custodian can be an important resource below, assisting you towards assets that line up with internal revenue service guidelines. Constantly bear in mind, while gold jewelry may be priceless to you directly, it’s normally not qualified for a Gold IRA.